Zero Hedge is a libertarian far-right financial blog that rose to popularity for being an alternative news website that didn’t shy away from exposing the cracks on Wall Street and sharing high-level data and intelligence on the financial market.

However, Zero Hedge has since evolved its offerings to include a mix of financial reflections coupled with news aggregation, evidence-free conspiracy theories, and editorial opinions on a variety of subjects ranging from politics to social and ideological issues.

According to Zero Hedge’s ethos as advertised on its website, the platform aims to provide analysis unrestrained by political correctness and to enable the freedom of financial, economic, and political information.

But how exactly does it go about accomplishing this? Is Zero Hedge truly a site where you can find useful investment information? How did the platform come to be and who is behind this controversial website?

Today, I will be taking a deep dive into Zero Hedge to provide some insight on the site’s history, purpose, and current standing. I’ll also examine similar sites like Zero Hedge that you can explore if you want to diversify your financial and political news sources.

Also Read: TheConservativeTreeHouse.com Alternatives, Reviews, History

Zero Hedge History

Zero Hedge published its first post on January 9, 2009, under the pseudonym, “Tyler Durden”, which is the name of the central character from the iconic film, Fight Club, based on the eponymous titled book by Chuck Palahniuk.

Almost all original articles published by Zero Hedge will go on to carry this fictitious byline regardless of who it is authored by.

Two days after Zero Hedge’s first appearance on the interwebs, the domain was registered in Bulgaria as a subsidiary of ABC Media Ltd. The company was managed by Krassimir Ivandjiiski, a Bulgarian editor and publisher of the right-wing, pro-Russia, and conspiracy theory website Strogo Sekretno (Top Secret).

Months later, it would be discovered that Krassimir is the father of the founder of the news blog.

Zero Hedge’s attempt at maintaining anonymity and protecting the identity of its owner didn’t last very long. By September 2009, Daniel Ivansjiiski, a former hedge-fund trader was outed by a news report as the founder of the website and voice behind “Tyler Durden”.

Also Read: The Gateway Pundit – Alternatives, History, Reviews

Born in Bulgaria during the Soviet Era, Daniel learned to speak multiple languages and was an exceptionally skilled pianist who abandoned this creative pursuit in favor of emigrating to the United States to become a doctor.

Upon graduating from the University of Pennsylvania in 2001 and realizing how much more lucrative a career on Wall Street would be, Daniel decided to pin his dreams on the finance industry.

Unfortunately, things took a rough turn seven years later when he got mixed up in insider trading, which led to him being banned from the securities industry.

Following the FINRA ruling, Daniel was forced to resign from his job at Wexford Capital LLC, a hedge fund founded by former Goldman Sachs Traders. Shortly afterward, he launched Zero Hedge with the goal of providing anonymous financial information and skeptical financial journalism.

Zero Hedge became an almost viral attraction, gaining millions of blog readers and social media followers. It also became so financially lucrative thanks to online advertising that it could hire dedicated in-house writers and pay them over 100,000 yearly to churn out content that would attract clicks.

By 2014, Zero Hedge’s Twitter following had grown to 215,000 followers. By January 20, 2020, the blog’s Twitter account boasted 670,000 followers when it was permanently banned from the social media site for violating Twitter’s platform manipulation policy.

Zero Hedge and other news outlets later reported that the suspension was a direct result of one of the publication’s articles: “Is This The Man Behind The Global Coronavirus Pandemic.”

In the article, they made unproven allegations claiming the virus was a bio-weapon and doxxed a Chinese virologist working at the Wuhan Institute of Virology.

Twitter would later reinstate Zero Hedge’s account after appeals on June 12, 2020. Since it returned to the bird app, Zero Hedge’s popularity has shown no signs of waning. It now has over 1.6 million Twitter followers.

As the years grew by, Zero Hedge has inched closer to the extreme, becoming a platform where people could unabashedly share bigoted, toxic, and hateful opinions and comments without being checked.

Seeing how much more popular and profitable its right-wing social and ideological posts were compared to finance posts, Zero Hedge seems to have committed to providing its growing alt-right audience with plenty of conspiracy theories and half-baked conservative rhetoric branded as facts.

In 2016, Colin Lokey revealed to Bloomberg that he, along with Daniel Ivansjiiski and Tim Backshall, a popular credit derivatives strategist, had been writing as the infamous “Durden” since 2015, when he joined the news website.

According to Lokey, he left the site because he could no longer be a 24-hour cheerleader for Trump, Moscow, Hezbollah, Tehran, and Beijing anymore.

Although he did his best to express as much truth as possible in the political posts he wrote for Zero Hedge, it was made clear to him that there was no room for that.

The website insisted on specific causes and political thoughts being framed through a very restrictive lens and attempts to veer away from this constructed narrative would be met with resistance.

At the time, Ivandjiiski denied these statements, claiming that Lockey was free to write whatever he wanted without anyone rewriting his opinions. However, both cursory and in-depth readings of the website lend support to Lokey’s version of events.

Although the website continues to provide financial information, data, and analysis, it is now better known for spreading conspiratorial, evidence-free views on social, political, and economic views.

Zero Hedge has received public support from a number of conservative, right-wing media and political figures including Katie Hopkins, Nigel Farage, Steve Bannon, and Donald Trump Jr.

Check Out: Unreliable Sources Examples

Zero Hedge Traffic

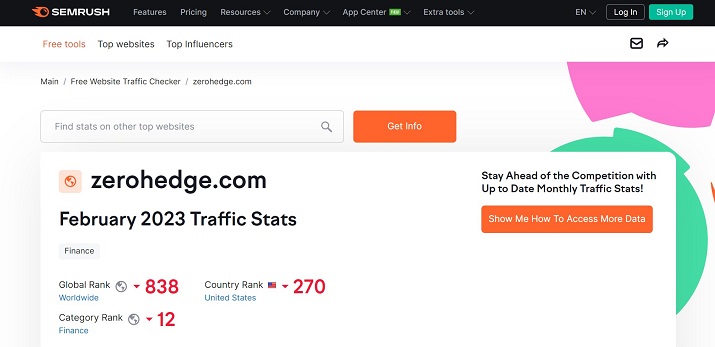

Zero Hedge easily qualifies as one of the most popular websites in the world. Based on Semrush’s analysis and data, Zero Hedge is the 838th most visited website globally and 270th most visited in the United States at the time of writing this article.

The website pulls in over 100 million visitors monthly on average with the average visitor spending up to 18 minutes perusing the blog before bouncing.

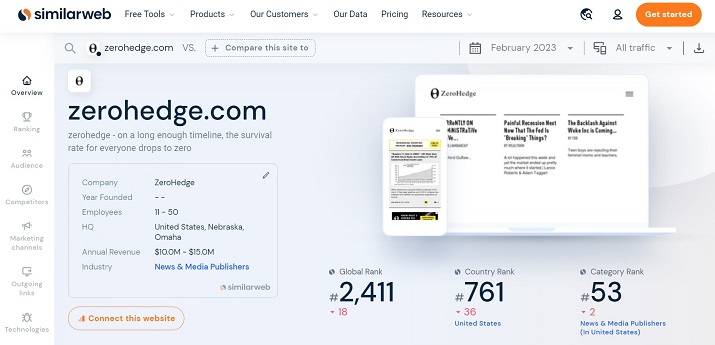

Data pulled from another website, SimilarWeb pegs Zero Hedge’s traffic at around 29 million visits per month with an average visit duration of 5 minutes and 28 seconds. While this figure is a lot more conservative than Semrush’s, it’s still a huge amount of traffic for a news website.

Most of Zero Hedge’s visitors—about 60%—come from the United States, which is understandable considering that most of the reporting and posts on the platform are focused on the U.S. financial markets, social issues, and politics.

The controversial news site also attracts a few million visitors from Canada, United Kingdom, Australia, Netherlands, and a couple hundred thousands from a host of other countries.

The generous amount of traffic that Zero Hedge gets can be attributed to its propensity for igniting controversy and sharing finance and investment information and opinions that may be hard to find anywhere else.

It also explains why the site has been able to stay profitable without relying exclusively on a subscription model to generate funds.

This many visitors means millions in potential eyeballs and hands that will view and click on ads displayed on the platform, which in turn translates to significant ad revenue.

Also Read: Weaselzippers.us Alternatives, History, Reviews

Zero Hedge Reviews

When it first arrived on the scene nearly one and half decades ago, Zero Hedge received praise from some circles for being a counter-culture investigative journalism outlet that shined an unflinching light on the hard truths and goings-on in the finance industry. But, it has since earned a reputation for being tendentious and problematic.

Many people and platforms have criticized the news site for spreading Russian propaganda as well as misleading, false, or unprovable theories, and sensationalist news.

Justin Fox, a well-known Financial journalist described the Zero Hedge blog as conspiratorial and most of the writing published on it as “half-baked hooey.”

According to CNN Money, Zero Hedge offers a deeply conspiratorial, pessimistic, and anti-establishment view of the world.

In an op-ed for The New York Times, Paul Krugman, a Nobel Prize winner in Economics categorized Zero Hedge as a scaremongering publication that thrives on advancing public fears about hyperinflation and touting absurd monetary policies.

Another Financial journalist, Paul Kedrosky writing for Time Magazine expressed that although he didn’t read Zero Hedge often because of its bearish one-track mind nature, he liked that it exists because it was very effective at weaning him off the idea that the economy might be alright after all.

The revered Finance Professor, Dr. Craig Pirrong, likens Zero Hedge’s modus operandi to that of a Soviet agitprop operation like Russia Today because it lends itself willingly and vehemently to the propagation of pro-Kremlin propaganda.

Going by these reviews, it is clear that Zero Hedge has serious objectivity and credibility issues. Although it can make for a fun, and at times, insightful read, it is filled with conspiracies and disinformation masquerading as news.

So if you must consume the content on this site, it is up to you to separate the wheat from the chaff and apply a hefty dose of skepticism to whatever information you find on it.

Zero Hedge Alternatives

You don’t have to deal with the hard-line ideologies, conservative opinions, and unsubstantiated data that have come to define Zero Hedge if you don’t want to.

There are many alternatives to Zero Hedge that provide excellent financial and political news, information, and analysis without serving them alongside a heap of absurd theories and conspiratorial assertions.

Let’s take a look at some of them.

1. Dealbreaker

Dealbreaker is an excellent financial blog that offers news, entertainment, original commentary, and coverage of the culture and personalities that are influencing the finance ecosystem.

If you’re looking for an alternative to Zero Hedge that doesn’t take itself too seriously and delivers thought-provoking and precise analysis of the happenings on Wall Street and the global finance market, you’ll be hard-pressed to find a more scintillating read than Dealbreaker.

Dealbreaker has categories dedicated to providing informative, up-to-date reporting on specific subjects. There’s a news section for cryptocurrencies, banks, and hedge funds.

It even has a Careers page where you can find job openings in the finance sector as well as articles on job trends, layoffs, and other information that employees and job seekers might find relevant.

MBA students will definitely benefit from Dealbreaker’s MBAs segment which shares gossip and news involving or relating to business schools and students across the United States.

You can also subscribe to the Dealbreaker newsletter to get insightful financial news delivered straight to your inbox.

2. Bloomberg

From actionable insights to groundbreaking sector-framing research and market-moving news, Bloomberg can be counted on to provide the trusted information you need to make key financial decisions in real time.

Bloomberg helps finance professionals and novices alike to find clarity in the midst of the complex and overwhelming wave of information that defines our world. It takes billions of data points and converts them into meaningful and actionable insights.

The publication has over 2,000 journalists working tirelessly to bring you thousands of real news updates, ideas, intelligence, and developing stories in the world of finance and business from over 120 countries.

Bloomberg’s news and opinion pieces are grouped into categories to make them easier to find. Whether you’re interested in politics, technology, crypto, economics, industries, and more, you’ll find plenty of information to keep you occupied and informed.

Unlike Zero Hedge which only uses the written word to transmit information, Bloomberg offers multichannel storytelling so you can consume its content via textual, visual, audio, and even live formats.

3. The Daily Reckoning

The Daily Reckoning has been serving as an independent financial forecaster since 1999 and has built a track record of being reliable and a great predictor of events pertaining to the financial market.

Like Zero Hedge, this publication examines the world and finance industry, makes informed guesses about the directions they will take, and offers advice on how you can take advantage of these trends or protect yourself from potential negative outcomes.

However, The Daily Reckoning accomplishes this without sensationalism, radical ideological stances, or resorting to conspiratorial thinking.

Whether you’re digesting your reckonings via the blog’s newsletter or website, you’re guaranteed to get interesting investment analysis and brilliant insights into the world of finance, politics, and economics.

The Daily Reckoning breaks down all the confusing information out there, infuses with much-needed context, and delivers it in a way that makes sense and applies directly to you.

4. Business Insider

If you don’t want to go through the trouble of sifting through the noise on Zero Hedge to find the slice of valuable financial information you need, you can head straight for Business Insider.

Insider is a business and finance-oriented global news publication with multiple outlets focusing on different world markets. The platform’s goal is to educate, inform, and motivate you with interesting stories and scoops that are worth knowing.

On Business Insider’s website, you’ll find a wide array of information and news spanning topics like advertising, healthcare, markets, culture, travel, entertainment, politics, sports, and many more.

The publication also offers opinion pieces for those who want a more personal analysis of current events through the point of view of an expert. Additionally, Business Insider has location-based newsletters that you can subscribe to get daily updates conveniently delivered to your inbox.

5. Naked Capitalism

Naked Capitalism is another Zero Hedge alternative that’s worth checking out if you want a news publication that delivers informed analysis of financial and economic issues using a critical approach.

Sussan Webber, the principal of the leading management consulting firm, Aurora Advisors Incorporated founded the finance news blog.

Like Zero Hedge’s Ivandjiiski, Webber chose to publish her posts for Naked Capitalism using a pen name Yves Smith. Her articles were preoccupied with sharing and analyzing the latest trends and events happening in the finance and economic space.

Naked Capitalism has since grown to include other contributors with seasoned experience in the financial sector.

However, the platform’s reporting remains focused on critiquing the ethical and legal issues of mortgage foreclosure processes, the banking industry, and the effect of past financial crises on the global economy.

The allure of Naked Capitalism is its insistence on telling it as it is and helping readers filter through the noise and dig into what’s happening beneath the surface of trending financial policies and major news stories.

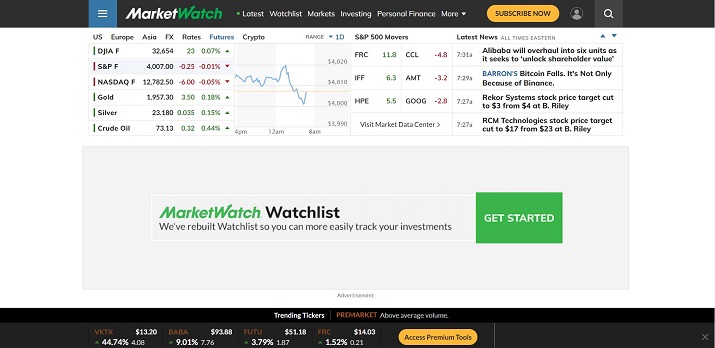

6. MarketWatch

MarketWatch is a comprehensive finance and investment website that helps you keep an eye on the latest news and updates in the stocks and securities market. You can find tons of articles, guides, analyses, and more on a variety of investment topics.

MarketWatch makes it easy for you to find the information you need by grouping them into different categories ranging from investing to personal finance, markets, economy, and retirement.

It also provides video resources explaining different financial concepts and strategies in interacting and engaging formats.

While Zero Hedge only focuses on delivering news and analysis, MarketWatch takes things a step by letting you monitor how your assets are performing in real-time.

With the platform’s Watchlist feature, you can select specific stocks that you want to track and get news, articles, performance snapshots, and other relevant market data relating to them.

Although a huge chunk of MarketWatch’s content is available for free, the site also offers subscriptions that you can invest in to access exclusive content and drastically reduce the number of ads you have to tolerate.

7. Pragmatic Capitalism

Pragmatic Capitalism is a finance and economics blog run by Cullen Roche, a renowned accountant who is best known for his work and expertise in quantitative risk management, monetary theory, behavioral finance, and global macro portfolio construction.

Roche founded Pragmatic Capitalism in 2008 to help (wannabe) investors gain a better understanding of the complex world of finance and economics.

He provides analysis, predictions, and answers to your toughest money-related questions through a broad-minded answer unbiased lens.

Drawing from his wealth of experience in portfolio management, financial accounting, private investment partnership, monetary systems, and finance markets, Roche furnishes readers of Pragmatic Capitalism with the knowledge they need to be more financially aware and responsible.

Pragmatic Capitalism also functions as a platform where financial analysts, economists, investors, and laypeople can debate financial matters and uncover hidden solutions to money problems.

All you have to do is subscribe to the blog to receive and be alerted about new content when it drops.

8. The Wall Street Journal

The Wall Street Journal is one of the most reputable, popular, and oldest financial blogs around. It launched in July 1889 with a mission to chronicle the relentless march of globalization, as well as the rise and fall of industries and consumer economies across the world.

The Journal provides coverage on a variety of topics including tech, sports, politics, economy, style, markets, books & art, life & work, and real estate. It also publishes opinion pieces where experts give their assessments of the complex issues plaguing the world.

Unlike Zero Hedge which tends to rely on the practice of insisting upon itself as proof of the veracity of the claims it makes, the Wall Street Journal painstakingly exercises due diligence to ensure the stories it publishes are credible.

The Journal takes a neutral, non-partisan tone in its articles, committing to telling the truth rather than trying to sell an agenda.

So if you need a source that provides the best and up-to-date scoops on business, economics, finance, and global affairs without embellishments or conjecture, don’t hesitate to consult The Wall Street Journal.

Wrapping up

Zero Hedge is a very popular news platform that shares stories and opinions that don’t get covered by major news outlets.

However, a lot of the information on the site is not backed by credible sources and may not be valuable to people looking for unbiased information on financial, political, and socio-cultural topics.

While it has some value to offer, it cannot and should not be used as a solitary source for financial news and analysis.

There are plenty of alternative media publications that offer more balanced, trustworthy, and critically-examined views that you can follow instead.