Nowadays, all the cool deals, discounts, and promos don’t last long. We’re so used to getting things quickly and easily that we’ve become impatient.

We want things immediately, and marketers know it. Thus, it’s become irresistible to whip out our credit cards and order stuff online the moment we see a “20% off” sign.

Buy now, pay later deals are exactly what they sound like. You can make a purchase now and pay for it later, usually in instalments.

Some buy now, pay later sites also offer no credit check and instant approval, which is helpful if you have a bad credit or no credit history at all.

These online credit shopping sites can be really helpful. They allow you to purchase without paying immediately.

It can free up cash flow in the short term, which is helpful if you’re tight on money or need to make an emergency purchase.

You don’t have to pay interest on your purchase with BNPL deals. With credit cards, you typically have to pay interest on your balance if you don’t pay it in full each month.

BNPL deals usually have a set time frame for repayment, so you know exactly when you need to have the money available.

In contrast, credit card companies may give you a grace period of 21-25 days before charging interest on your balance.

The following are some of the best buy now, pay later, no credit check, instant approval websites.

Best Buy Now, Pay Later, No Credit Check, Instant Approval Websites

1. Affirm

This publicly-traded fintech firm offers BNPL deals on big-ticket items like mattresses, electronics, and travel. It even has a specialized category for black-owned businesses, and the credit limit goes up to $17,500.

The company was founded in 2012 by Max Levchin, who also co-founded PayPal, and Jeff Kaditz. It is headquartered in San Francisco, California.

Affirm is web-based, but it works best on its freely downloadable app. It allows you to pay in two options:

Affirm Pay in 4

This payment option allows you to pay in four interest-free installments every two weeks. The payments will be easy and automated.

Monthly Payments

You can schedule monthly payments with no hidden or late payment fees. However, monthly payments present a minute interest charge. This option allows up to 48-month repayments, but the APR ranges from 0-30%.

Affirm is a better alternative to credit card shopping. The staff never runs a hard credit check, so it never negatively impacts your credit scores.

It could help improve your credit scores by avoiding frequent or high-ticket credit card spending. It also offers a chance to break bad spending habits.

To use Affirm, simply select it as your payment method at checkout on thousands of websites or in-store. You’ll know if you’re approved for a loan in real-time. Once you’re approved, enter some basic information and confirm your loan.

You can pay later with your credit or debit card. That’s it!

Explore the best alternatives to Affirm here.

2. Cash App Afterpay

Afterpay is now Cash App Afterpay.

It is an Australian fintech service with an international outreach. Americans, Canadians, and Australians all have access to it.

Afterpay enables shoppers to buy now and pay later for their purchases without interest or fees.

Afterpay has partnered with over 80,000 retailers to be their distributors. Thus, it offers a wide range of products, and it doesn’t need to charge interest rates for profits.

You can shop online or in-store at any merchant that offers Afterpay. At the checkout, select Afterpay as your payment method. Proceed to choose how much you would like to pay upfront, either the whole amount or a partial amount.

Afterpay allows you to make a small down payment and complete the rest of the payment in four installments, each after two weeks. It will take you six weeks to complete the payments.

You can remit payments with debit or credit cards. The signup process is easy, only fill out an online form with your:

- Address

- Email address

- DOB

- Viable debit or credit card

- Phone number

Late repayments attract a $10 late fee and $7 more if you’re more than seven days late. Afterpay will also send you SMS reminders before each repayment is due.

Find out more apps like Afterpay.

3. Klarna

Klarna is a Swedish bank that offers financial services to international consumers and merchants. It was founded in 2005 and had over 121 million users worldwide by 2021.

Klarna is available in 18 countries and works with over 400K online merchants.

You can use Klarna at checkout on many popular websites and apps, including ASOS, Nike, H&M, and Sephora.

Klarna has a wide range of payment options. It doesn’t run hard credit checks when you’re taking the ‘Pay in 4’ option.

You can use this option to split any purchases into smaller payments. The option comes with zero interest rates, and you can manage payments from the app wherever you go.

The caveat is a $7 late payment fee.

The second option is the ‘Pay-in-30-Days’. It allows you to seize fleeting promos and discounts when you’re short of cash and pay when you get your paycheck.

Klarna will also let you know if there’s a better financing option for the items in your cart.

For example, no other BNPL app gives a repayment period of 36 months. The three-year deal is ideal for high-ticket purchases, but it attracts an APR of 0-24.95%.

Check out more apps like Klarna.

4. Perpay

Perpay is one of the popular buy now pay later sites that helps split your purchase into 12 equal monthly payments, interest-free.

It helps you spread your payments of high-ticket purchases into paycheck installments that make it more affordable to amass assets.

This Philadelphia-based fintech company doesn’t run hard credit card checks, nor does it report to Experian and Equifax credit bureaus unless it boosts your scores. At no point will Perpay ever affect your credit scores negatively.

So, how does Perpay protect itself from bad credit risk? Well, users need to pay a partial deposit, which must be deposited directly into their accounts.

Perpay then garnishes the other scheduled monthly installments from your paycheck. It’s not like other BNPL websites that accept credit and debit cards. Thus:

- Perpay doesn’t serve users with active bankruptcies.

- It only serves employed users with annual salaries of $15,000 or more.

- It requires users to have active mobile phone numbers.

Perpay does not charge interest rates or late fees. It profits through the deposits and service fees that it charges the retailers on its networks.

Perpay is worth considering if you’re looking for a BNPL website that doesn’t negatively affect your credit scores.

Read this post that discusses the best alternatives to Perpay.

5. Splitit

Splitit helps stores, retailers, and merchants to reach more users by enhancing the buying experience through installment payments. It does not acquire user data, nor does it steal retailers’ existing clientele.

The fintech service doesn’t run hard credit checks, nor does it charge interest rates.

With Splitit, you don’t need to apply as the approval is instant. You only need to create an account and link your credit or debit card.

Once you’re all set up, you can start shopping at any of the online or brick-and-mortar retailers that accept Splitit. When you get to the checkout page, select Splitit as your payment method.

You’ll be asked to enter the amount you want to pay upfront and how many installments you’d like to make.

Your first installment will be charged to your card immediately, and subsequent payments will be charged automatically on the date you choose. You can also make manual payments at any time through the app.

One of the great things about Splitit is that you don’t need to reapply every time you want to make a purchase. As long as you have available credit, you can use Splitit repeatedly.

The security Splitit deploys is first class, and it never stores any of your credit card details on its servers.

Also Read: Best Apps Like Albert

6. Sezzle

This Minneapolis-based financial service allows you to shop now and pay later. Sezzle is perfect if you want to buy something now but don’t have the money upfront.

With Sezzle, you can spread your purchase over four interest-free installments that you clear in six weeks.

This shopping app links to your debit or credit card, automatically honoring the scheduled payments. You’ll pay a small fee for rescheduling payments.

Sezzle allows you to access BNPL deals in over 47,000 stores at the checkout stage. It’s currently available at select retailers, both online and in-store. Physical shoppers often need to scan QR codes at the register to use Sezzle.

Sezzle confirms your identity, and it runs a soft credit check. Thus, it doesn’t affect your credit score, but the check determines your Sezzle spending limit. You can get a decent limit with bad credit, and your repayment history will boost your limits.

However, the first deposit must be over 25% of the total value.

It also doesn’t support all banks, so don’t be surprised if your card is declined. You’ll pay a $10 late fee for each defaulted transaction, with a two-day grace period. Also, the first payment rescheduling is free.

Sezzle is a great option if you want to avoid debt and interest free payments. It’s also excellent for building credit without taking on more debt.

Explore: Best Quicken Alternatives

7. Zip (formerly Quadpay)

Zip is a payment platform that allows you to shop now and pay later in four interest-free installments. You can buy a product today, pay a small deposit, and complete payments for it within six weeks without breaking the bank.

Zip is available at over 20,000 online stores, including Amazon, Walmart, Best Buy, Target, eBay, and StockX. So it makes it easy to budget for your purchases.

This fintech service is based in New York, and it honors Federal KYC rules. To avoid involvement in money laundry schemes, Zip demands you provide your:

- Official name

- Date of birth

- Email address

- United States address and mobile number

- Last four digits of your SSN or other government ID

Zip only serves Americans, and it doesn’t have an international outlook. It doesn’t charge interest rates, but you’ll pay $7 in late fees if you delay the payment by a week.

If the delay exceeds seven days, the late fee goes up to $14, but it never accumulates past $14.

The best part about Zip is that it never runs hard credit checks. It also doesn’t report your shopping lending. Thus, you can avoid credit card shopping and gradually improve your credit scores.

Check Out: Best Apps Like Chime Bank

8. PayWithFour

This app is amazing!

Four allows you to shop at any partnering online stores and pay with your phone. No more waiting in line or carrying around cash!

Its best feature is its pay now pay later option. You can shop now and pay later with no interest!

Four easy payments makes it easier to afford to pay for unexpected offers or emergencies. You can pay through the app, which you can download through Google Play or the App Store.

It doesn’t run hard credit checks that impact your scores. Despite its cost-friendliness to users, Four earns by distributing via retailers.

Merchants and retailers benefit from Four because it allows them to get customers who wouldn’t normally shop with them. The app is currently available in the US, UK, and Canada.

It’s most favorable for lifestyle shopping, and it suits fashion, jewelry, pets, and accessories. It’s a good alternative to credit card shopping!

9. Amazon BNPL

Amazon BNPL is a new way to shop on Amazon, one of the world’s leading online stores. You can pay for your purchase over time, interest-free with BNPL.

There are no fees or penalties for early repayment, and you can choose from various repayment plans.

BNPL is available on select items sold by Amazon and select third-party sellers. To use BNPL, you must be an Amazon customer and have a valid credit or debit card.

The program doesn’t check your credit to approve you.

When you check out with BNPL, you’ll need to provide your name, address, contact information, and credit/debit card number. You’ll also be asked to create a username and password.

After you complete the checkout process, you’ll receive an email confirmation. You can then log in to your account to view your order summary and payment schedule, and make payments.

The flexibility of setting a payment schedule that fits you makes it easy to pay for your purchases over time.

Amazon BNPL is a great way to manage your budget and shop on Amazon simultaneously.

10. PayPal BNPL

PayPal BPNL is great for small purchases.

It focuses on completing purchases ranging from $30-$15,000 in a few clicks. There are no fees associated with using PayPal BNPL.

Another good thing about PayPal is that it offers instant credit to shop now and pay later without any interest or added fees. You only need to pay a 25% deposit for the value of your purchase and complete the rest in three instalments.

You can use this service with millions of online stores that accept PayPal. Thus, you can make payments using your debit card, credit card, or bank account.

If you’re looking for a BNPL option that doesn’t charge any interest or fees, PayPal BNPL is a great choice. You won’t be subjected to lengthy approval waits or credit checks that hurt your credit score.

This service is yet to make its presence in all 50 states though.

11. Credova

Credova is a redeeming resource for people with bad credit.

It offers a variety of options for people with bad credit including loans, credit counseling, and debt consolidation.

This BNPL app can approve you for $5,000 without running a hard credit check, meaning it won’t affect your score. You can then pay for your high-ticket purchases in four easy payments that attract no interest rates.

Just imagine the effects of running up a $5K purchase on your credit card, especially with bad credit. It would cost you way more than the high-interest rates, or you’d probably get declined.

Credova is an adventure-based service that helps people with bad credit get the funding they need for life’s little emergencies and big adventures.

12. American Express

American Express is a credit card issuer founded in 1850.

Amex cards are accepted in over 130 countries and offer many perks, such as cashback, travel rewards, and 24/7 customer service.

You can also use your American Express card to make online purchases and pay your bills.

American Express BNPL service allows you to skip the credit check and get instant approval at 0% interest rates. You can take out a $100 credit on purchases and schedule to pay within 3-24 months.

The BNPL attracts a 1.33% fee on the value of your purchases.

You have to hold an American Express credit card to access instant, no-credit-check approval on this plan.

Check Out: Annul Income – What Does It Mean & How To Calculate

13. Flex Pay by Upgrade

15. Bread Pay (Bread Financial)

Bread Pay allows consumers to split purchases into instalments at checkout.

It typically performs a soft credit check during pre-qualification and a hard credit check if the consumer accepts the financing offer.

Approval is often instant or near-instant, depending on the borrower’s details. Bread Pay partners with a wide range of retailers, from electronics to home goods, allowing for a seamless payment experience.

Loan terms can vary, including options like Pay in 4 or longer financing up to 36 months. It is fully operational in the U.S. and regulated under Bread Financial, a well-established consumer finance company.

Shoppers benefit from its transparent terms and no hidden fees.

16. Zebit

Zebit is a U.S.-based BNPL platform that offers consumers the ability to buy now and pay over time through its own online marketplace.

It does not perform a hard credit check, making it attractive to users with thin or poor credit histories. Instead, Zebit uses alternative data and soft checks to determine eligibility.

Approval is usually quick, and shoppers receive a spending limit upon sign-up. Unlike traditional BNPLs, Zebit sells products directly on its platform, offering everything from electronics to home goods.

The company promotes itself as a no-interest, no-fee alternative with transparent terms.

Zebit is currently available to U.S. residents and is known for being accessible to those who might not qualify for mainstream financing.

17. Sunbit

Sunbit is another BNPL provider specifically designed for everyday needs like dental care, auto repairs, vision, and other service-based industries.

It’s widely used in-store across the U.S., especially at healthcare and auto dealerships.

Sunbit performs a soft credit check during the application process, which does not affect the user’s credit score.

Approval is near-instant, typically taking less than 30 seconds. It boasts an approval rate of over 90% for qualified applicants.

Payments can be spread across 3 to 24 months, depending on the merchant and user eligibility.

Sunbit focuses heavily on helping underserved consumers access essential services affordably.

18. ViaBill

ViaBill, from Denmark, is another BNPL service operating in both Europe and the U.S., allowing consumers to split their purchases into four interest-free payments.

In the U.S., ViaBill typically performs a soft credit check, which does not impact credit scores. Approval is usually instant, and users can use it at participating merchants both online and offline.

The standard offering is similar to other Pay-in-4 solutions, with a clear, short-term payment schedule. ViaBill is appealing for consumers who want flexible payments without the risk of debt escalation or hidden fees.

The company emphasizes transparency and ease of use, and it is active in various retail categories. Its U.S. operations are growing, although its merchant network is more limited compared to larger players like Klarna or Afterpay.

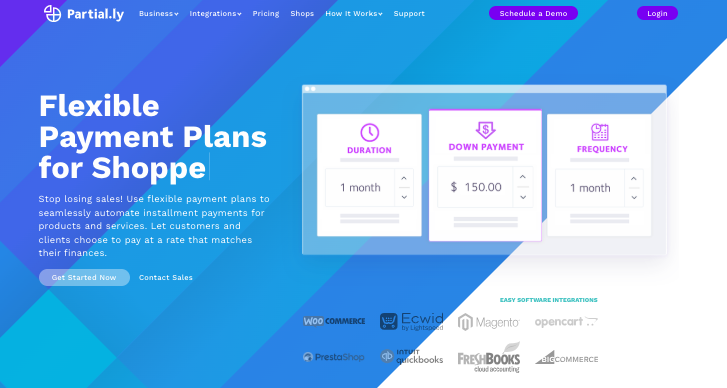

19. Partial.ly

Partial.ly is a flexible payment plan provider that works both for individual users and businesses setting up their own installment options.

It operates in the U.S. and internationally, supporting merchants that want to create customized BNPL experiences.

Partial.ly does not perform any credit checks on consumers, making it ideal for those with limited or bad credit.

Instead, eligibility is determined by the merchant and user’s payment method.

Approval is generally instant, as long as a valid debit or credit card is provided. Consumers can use Partial.ly at participating merchants offering this service on their site.

Its main strength is customization, allowing businesses to set down payments, interest, and duration. It’s especially popular among smaller online retailers and service providers.

20. Credit Key

Credit Key is a U.S.-based BNPL service. It is focused specifically on B2B transactions, allowing businesses to finance purchases with Net terms or instalment plans.

It does require a soft credit check and a business verification step during application but approval is usually fast, often within minutes, though in some cases it may take longer if more documentation is needed.

Credit Key offers terms ranging from 30 days to 12 months, and businesses can borrow up to $50,000 depending on their eligibility.

It’s a solid option for small to mid-sized companies needing flexible payment options for inventory, equipment, or supplies.

Credit Key partners with a variety of B2B merchants in the U.S. only. While not for personal use, it fills an important gap in business financing.

Final Thoughts

While all these players are some of the best in the BNPL industry, Affirm stands out.

It offers transparent, and flexible payment options with no hidden fees or late charges, making it highly consumer-friendly.

Klarna is the more suitable for high-ticket purchases. Whereas Perpay and Splitit are ideal for users with bad credit.

Pick the one that suits you. All are good at their business.

Enjoyed the post?