Late payments are one of the most frustrating challenges freelancers, small business owners, and service providers face.

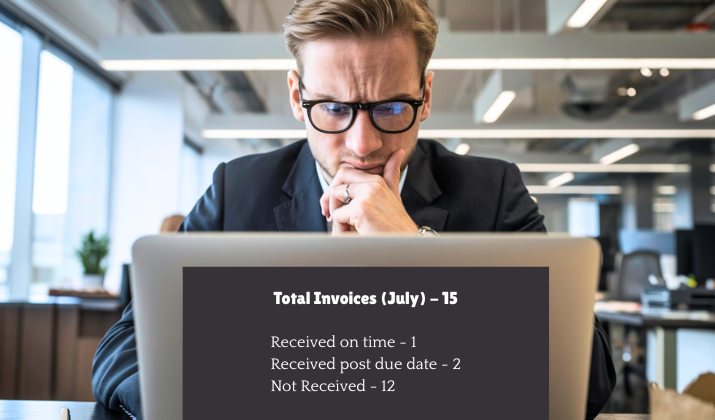

According to a study, on an average, small businesses in the US receive payments eight days late. 55% of all invoices issued in the country are not paid on time. More than 22% of entrepreneurs feel that the trend is not going to change in future.

These numbers are discouraging to say the least.

While there is very little you can do to help it, your efforts must not stop. Did you know that a well-crafted email can be the difference between writing off bad debt and getting paid promptly?

The key to effective payment collection isn’t aggression or threat. It’s strategic communication that balances professionalism with increasing urgency.

Each email in your sequence should serve a specific purpose, from gentle reminders to firm final notices.

We have shared some email templates below that usually work. In fact, they work across industries because they focus on maintaining relationships while clearly communicating consequences.

Take a look and find out what kind of emails you can draft to expedite, and persuade people to pay on time.

Also Read: Polite Follow-Up Email Examples (Requesting Someone)

1. The Friendly Reminder

Why it works: This template assumes positive intent and gives the client an easy way to save face. Most late payments are simply oversights, and a gentle nudge often resolves the issue without damaging the relationship.

Template:

Subject: Quick reminder - Invoice #[Number] payment

Hi [Client Name],

I hope you're doing well! I wanted to send a quick reminder that payment for Invoice #[Number] (dated [Date]) was due on [Due Date].

I know how busy things can get, so I thought I'd reach out in case it slipped through the cracks. The outstanding amount is $[Amount] for [brief description of work].

If you've already sent payment, please disregard this message. If you have any questions about the invoice or need me to resend it, just let me know.

Thanks as always for your business!

Best regards,

[Your Name]Explore: How To Write A Professional Apology Email? (With Examples)

2. The Second Notice

Why it works: This template introduces a bit more urgency while still maintaining professionalism. It references the previous email to show you’re tracking communications and subtly implies a pattern of follow-up.

Template:

Subject: Second Notice - Invoice #[Number] now [X] days overdue

Hi [Client Name],

I'm following up on my previous email regarding Invoice #[Number] for $[Amount], which is now [X] days past due.

I understand that sometimes invoices can get lost in the shuffle, so I've attached a copy of the original invoice for your reference. The work covered includes [brief description].

To avoid any service interruptions or late fees, please prioritize this payment. If there are any issues with the invoice or if you need to discuss a payment plan, please reach out to me immediately.

I appreciate your prompt attention to this matter.

Best regards,

[Your Name]Explore: Best Professional Thank-You Email Examples

3. The Problem-Solver

Why it works: This template acknowledges that there might be legitimate reasons for the delay and opens the door for communication. It shows you’re willing to work together while making it clear that ignoring the issue isn’t an option.

Template:

Subject: Let's resolve Invoice #[Number] - Payment options available

Hi [Client Name],

I've reached out a couple of times regarding Invoice #[Number] for $[Amount], which is now [X] days overdue. Since I haven't heard back, I wanted to check if there are any issues or concerns I can help address.

I understand that cash flow can sometimes be challenging, and I'm happy to discuss payment options such as:

- A payment plan with agreed-upon installments

- A partial payment now with a schedule for the remainder

- Alternative payment methods if needed

What's most important to me is finding a solution that works for both of us. Could you please respond by [Date] to let me know how you'd like to proceed?

I value our working relationship and look forward to resolving this quickly.

Best regards,

[Your Name]Also Read: Best Company Introduction Email Samples

4. The Firm But Fair Message

Why it works: This template shifts to a more serious tone while still offering solutions. It introduces consequences without being threatening, making it clear that the situation has escalated beyond simple oversight.

Template:

Subject: URGENT: Invoice #[Number] requires immediate attention

[Client Name],

Invoice #[Number] for $[Amount] is now [X] days past due, and I have not received any response to my previous emails. This is concerning as it's unlike our usual business relationship.

I need to resolve this matter immediately. At this point, I require either:

- Full payment of $[Amount] by [Date]

- A confirmed payment plan with the first installment by [Date]

- Direct communication about any disputes or issues with the invoice

Please be aware that if I don't hear from you by [Date], I will need to consider additional collection measures, which may include:

- Suspension of current/future services

- Transfer to a collections agency

- Reporting to credit agencies

I would much prefer to resolve this directly with you. Please contact me immediately at [phone number] or reply to this email.

Regards,

[Your Name]5. The Last Chance

Why it works: This template creates genuine urgency by clearly stating consequences and deadlines. It’s firm but professional, giving the client one final opportunity to respond before escalating.

Template:

Subject: FINAL NOTICE - Invoice #[Number] - Action required by [Date]

[Client Name],

This is my final notice regarding Invoice #[Number] for $[Amount], which is now [X] days past due.

Despite multiple attempts to reach you, this invoice remains unpaid and I have received no communication from you regarding this matter. This is unacceptable and contrary to our agreed payment terms.

You have until [Date - typically 7 days from email] to either:

1. Pay the full amount of $[Amount], or

2. Contact me to arrange an acceptable payment plan

If I do not receive payment or hear from you by [Date], I will immediately:

- Suspend all current and future services

- Turn this account over to a collections agency

- Report this debt to credit reporting agencies

- Consider legal action to recover the debt plus additional fees

This is not the outcome I want, but continued non-payment leaves me no choice.

[Your Name]

[Phone Number]Also Read: Best Short & Sweet Follow-Up Emails Post Interview

6. The Authority Figure

Why it works: This template leverages the psychological impact of third-party involvement. Even mentioning collections or legal action often motivates immediate payment, as most clients want to avoid these complications.

Template:

Subject: Invoice #[Number] - Collections process initiated

[Client Name],

As of today, Invoice #[Number] for $[Amount] is [X] days past due. Since you have not responded to my previous notices or made payment arrangements, I am now forced to begin the collections process.

This account is being prepared for transfer to [Collections Agency Name] and will be reported to credit agencies. Once this process begins, additional fees and interest will be added to your balance.

However, I am willing to halt this process if you contact me immediately with either:

- Full payment of $[Amount] by [Date]

- A confirmed payment agreement signed by [Date]

This is your final opportunity to resolve this matter directly. After [Date], all communication will need to go through the collections agency.

[Your Name]

[Your Business Name]

[Phone Number]Also Read: Best Thank-You Email Examples Post Zoom Interview

7. The Relationship Reminder (For Long-term Clients)

Why it works: This template is specifically designed for clients you’ve worked with successfully before. It emphasizes the relationship and previous positive history while still being firm about payment expectations.

Template:

Subject: Let's get back on track - Invoice #[Number] discussion needed

[Client Name],

I've been thinking about our [X years/months] of working together, and I have to say this payment delay is really out of character for you. We've always had such a smooth working relationship, which is why I'm genuinely concerned about Invoice #[Number] being [X] days overdue.

I know you're good for it—that's never been in question. But I also know that my business depends on timely payments to keep serving you and my other clients effectively.

Can we jump on a quick call this week to discuss what's going on and how we can get this resolved? I'm confident we can figure out a solution that works for both of us, just like we always have.

I really value our partnership and want to make sure we can continue working together successfully.

Give me a call at [phone number] or let me know what time works best for you.

Thanks,

[Your Name]8. The Consequence Clarifier (For Ongoing Services)

Why it works: This template works particularly well for recurring services or ongoing projects. It clearly connects payment with service continuation, making the consequences immediate and tangible.

Template:

Subject: Service interruption notice - Invoice #[Number] payment required

[Client Name],

I need to inform you that due to the outstanding balance on Invoice #[Number] ($[Amount], now [X] days overdue), I will need to pause all work on your account effective [Date].

This includes:

- [List specific services/projects that will be paused]

- [Any recurring deliverables]

- [Access to tools/systems if applicable]

I understand this may impact your business operations, which is why I'm giving you [X] days' notice. Services can resume immediately once payment is received.

If you need to discuss payment arrangements or have questions about the invoice, please contact me by [Date] so we can resolve this before the service interruption takes effect.

I hope we can get this sorted out quickly so we can continue our work together.

Best regards,

[Your Name]Also Read: Best LinkedIn Inmail Examples

9. The Peer-to-Peer Appeal (For Fellow Business Owners)

Why it works: This template creates empathy by acknowledging that you’re both business owners who understand cash flow challenges. It’s more personal and often resonates with clients who run their own businesses.

Template:

Subject: Business owner to business owner - Invoice #[Number] conversation

[Client Name],

I'm reaching out as one business owner to another about Invoice #[Number] for $[Amount], which is now [X] days past due.

I know you understand the challenges of running a business and managing cash flow. I also know that you'd want to handle this professionally, just as I've tried to do.

The truth is, this overdue payment is affecting my ability to serve my clients effectively and meet my own financial obligations. I'm sure that's not the impact you intended.

I need to resolve this by [Date]. Whether that's full payment, a payment plan, or even just a conversation about what's happening on your end—I just need to know where we stand.

Can you help me understand what's going on and how we can move forward?

I'm available at [phone number] or you can reply to this email.

Thanks for your time and attention to this matter.

[Your Name]10. The Professional Farewell (Final Communication)

Why it works: This template serves as a professional conclusion to your collection efforts. It clearly states what will happen next while maintaining dignity and leaving the door open for future resolution.

Template:

Subject: Final communication - Invoice #[Number] transferred to collections

[Client Name],

This is to inform you that Invoice #[Number] for $[Amount] has been transferred to our collections agency, [Agency Name], effective [Date].

All future communications regarding this debt should be directed to:

[Collections Agency Contact Information]

Please note that additional fees and interest charges may now apply, and this debt will be reported to credit agencies.

While I'm disappointed that we couldn't resolve this directly, I want to thank you for the work we were able to complete together. If you resolve this matter with the collections agency, I would be open to discussing future projects.

I wish you success in your business endeavors.

Professional regards,

[Your Name]

[Your Business Name]Also Read: Bad Email Examples To Avoid

Conclusion

These email templates provide you with a systematic approach to collecting overdue payments while maintaining professionalism and preserving relationships where possible.

Start with gentle reminders and gradually increase the urgency and consequences.

Most importantly, always follow through on what you say you’ll do, whether that’s offering payment plans or involving collections agencies.

Enjoyed the post?