Bookkeeping is one of the most important requirements of running any business. Whether you decide to hire a bookkeeper or accountant, delegate the task to your employees, or handle the bookkeeping yourself, the choice is always yours.

A popular choice among many top businesses is the use of QuickBooks.

QuickBooks is an accounting software developed by Intuit that is mainly used by small and medium-sized businesses to manage business transactions, including billing, payroll, invoicing, and tracking expenses.

It is available either as a desktop or online version, with the latter being more popular.

QuickBooks allows you to easily track inventory, generate financial and management reports, manage taxes, and project profitability, among other features.

However, like any other software, QuickBooks has certain shortcomings that limit its popularity.

As a QuickBooks user, I have had first-hand experience in all matters of QuickBooks. In this post, I’ll discuss all the pros and cons of QuickBooks. I am sure it will help you to decide whether it’s the right software for your needs.

Let’s get started!

-

Pros of QuickBooks

- 1. User-friendly Interface

- 2. Compatibility & Integration with other software

- 3. Customizable Reports

- 4. Remote Access

- 5. Advanced Invoicing Systems

- 6. Advanced Payroll Features

- 7. Saves Time and Money

- 8. Advanced Inventory Management Systems

- 9. Keep Track of Expenses

- 10. Live Bookkeepers

- 11. Automated Check Signing

- Cons of QuickBooks

- Summary

Pros of QuickBooks

1. User-friendly Interface

QuickBooks is undoubtedly one of the easiest accounting software to learn and understand.

The software has an intuitive interface that makes it easy to operate and locate the features you need. Its modern design and feature-rich structure allow you to navigate and access its wide variety of tools easily.

QuickBooks provides you with adequate resources and documentation to help you, as a first-time user, to quickly understand its functionality. The software offers webinars, support articles, and tutorials that help you get started.

In addition, you can also troubleshoot any issues you may encounter while interacting with the large QuickBooks user community, where different issues are raised and experiences shared.

The user-friendly interface and easy-to-use platform are things that make QuickBooks stand out from other basic accounting software.

2. Compatibility & Integration with other software

For any business to succeed, it is important to ensure that the software used in various organization departments can work together to produce an integrated approach to all departments.

Businesses inculcate digital solutions to critical functions of the organization by using compatible applications and software to ensure they succeed in the market and stay compliant with business regulations.

With QuickBooks, you can achieve exactly that.

QuickBooks allows you to connect to eCommerce platforms, payroll management, and payment processors, making accounting much easier and seamless by ensuring unified integration.

Third-party tools and QuickBooks add-ons offer solutions to managers keen to step away from the daily task of bookkeeping and improve workflow to reduce human error.

QuickBooks’ compatibility with other software like Microsoft Excel allows you to streamline your processes by syncing customer data, simplifying invoicing systems, and exporting data to create understandable reports.

The software also enables integration with banks, financial institutions, and credit card companies that assist in payment processing.

3. Customizable Reports

Reports are a part of your daily analysis that help you understand the business’ position and trends. With QuickBooks, you can customize these reports to meet your specific needs.

Since a lot of time may be wasted in analyzing tons of information from reports, this feature makes accounting and analysis more straightforward, thus greatly reducing the amount of time it takes to interpret financial statistics.

By tweaking reports to fit your requirements, you are able to manage your company’s books more consistently and simply.

The ability to customize reports and invoices also goes a long way in ensuring that you do not have to dig deep into generic reports without specifics on what you need.

A fully customized accounting report provides the necessary information to improve your business and make sound financial decisions.

Also Read: ERP Software Examples

4. Remote Access

Modern businesses are embracing remote access to let their employees work from any location.

QuickBooks Online is a cloud-based version of QuickBooks that allows you to access the software from any location, provided you have internet access. This enables you to transfer folders or files between systems.

For the desktop version, you can access data remotely by hosting the software on third-party servers. An authorized user with internet access from any location can access the QuickBooks desktop application installed on the host server.

Remote access enables managers to easily monitor their financials and business and track accountants’ activities without any hassle.

With remote access, multiple users can work on the same QuickBooks file simultaneously to save time and costs.

However, it is important to note that the remote access feature is charged starting from $3.95 per month. More details can be found on their pricing page.

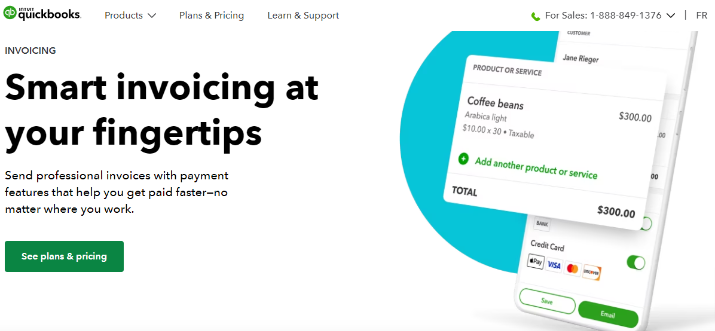

5. Advanced Invoicing Systems

QuickBooks features a smart invoicing system that allows you to edit invoice templates to your liking. You can change the font, add your business logo, and set up different languages and currencies to increase efficiency and professionalism.

In addition, it includes a “Pay Now” button that allows your customers to instantly pay for invoices via credit card or Apple Pay. This makes it easy for customers to pay invoices, thus reducing any chances of debt.

The invoice also calculates the taxes on sales of every invoice so that you can always know what you owe and earn.

You can also schedule any recurring invoices to be sent automatically to customers and create real-time alerts that track the status of all invoices.

Incurred an additional expense while working? QuickBooks’ progress invoicing allows you to link the billable cost to your invoice and recover the money once you get paid.

Also Read: 17hats vs Honeybook

6. Advanced Payroll Features

Payday is one of the biggest nightmares for business owners or managers. However, with the right payroll software, this process becomes dramatically easy.

Payroll software such as QuickBooks Payroll is necessary to keep track of employee data when filing taxes.

QuickBooks offers an advanced payroll feature that handles multiple services, from contractors’ dues to employee wages, while giving you various options to choose from when making payments.

QuickBooks’ Payroll allows you to organize and categorize employee information in a way that makes it easy for the organization and taxing authorities to analyze the data.

It also becomes useful when analyzing employee benefits such as health insurance and sick leave.

QuickBooks Payroll also helps you to prepare payroll taxes which goes a long way in avoiding mistakes associated with filing taxes, such as erroneous tax filings and wrong calculations.

QuickBooks’ add-ons, such as Full-Service Payroll and Self-Service Payroll, assist business owners in managing the intricate payroll requirements as well as complement the payroll solution that your business operates in.

This means that you do not have to abandon your original payroll applications when adopting QuickBooks’ payroll system.

7. Saves Time and Money

Do you often struggle to find enough time to check off your books? Well, QuickBooks is exactly what you’ve been looking for.

Time and money are two of the most important resources that any business can utilize to work efficiently and improve performance.

QuickBooks is not only used to keep you organized and help your business manage its books. In fact, in the right hands, QuickBooks can save your company thousands of dollars every year if you get the most out of it.

QuickBooks has a built-in payroll system integrated with the accounting system. This means you no longer need to outsource people to create payroll, and in turn, you can save money that would have been paid to third-party services.

QuickBooks’ versatility does not stop there.

In addition, QuickBooks features cloud storage that backs up your company’s data automatically. If there’s a system crash, you end up saving a lot of time that would have been used trying to recover data lost.

QuickBooks also simplifies the bill payment process and creation of invoices, saving more time and energy that can be channeled to other functions.

Also Read: Best 17hats Alternatives

8. Advanced Inventory Management Systems

Inventories are critical to the survival of any company, from retailers with ready-made products to manufacturers with raw materials.

To achieve maximum income and growth, it is important to have a well-designed inventory management system that ensures that inventory is always at optimal levels when required by the business.

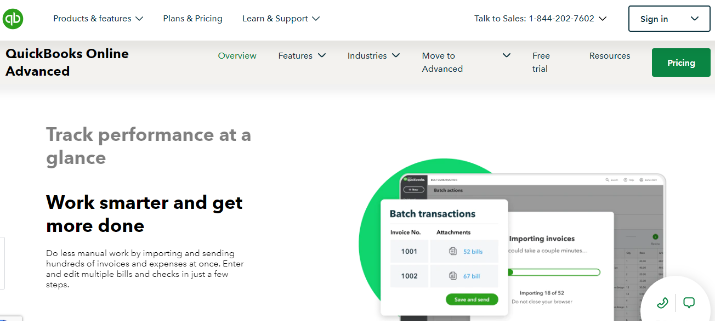

QuickBooks offers several advanced features and tools that facilitate extensive inventory management and effective management of your resources.

QuickBooks’ Enterprise Inventory Management System allows you to get real-time inventory visibility to ensure you have less inventory surplus at all times for greater productivity.

Its automated processes allow you to reduce human errors that may reduce profit margins as well as increase customer satisfaction through efficient and timely order fulfillment.

QuickBooks’ advanced inventory systems provide multi-level inventory categorization that gives you more control over your inventory and more granularity in inventory organization.

That’s not all.

You can also set expiration dates for inventory in stock to help reduce losses that may be experienced on the sale of expired products. Assigned expiration dates can also help you make timely decisions on expired or about-to-expire inventory.

With advanced inventory systems, you can apply serial numbers to inventory items, making it easy to conduct inventory searches and easily manage stock and warranty claims.

Other features of the advanced inventory system include lot number tracking, customizable inventory reports, cycle counts, barcode scanning, and cost tracking, among others.

9. Keep Track of Expenses

Tracking the expenses of your business is very important as it helps you improve the financial health of your company, identify and eliminate unnecessary spending habits, and acquire real-time visibility of your financial position.

QuickBooks allows you to sync your bank accounts, Square, PayPal, credit cards, and more to import and categorize your expenses in a way that allows you to run reports showing how every dollar is spent.

In addition, the QuickBooks mobile app allows you to save photos of receipts that are then automatically matched to an existing transaction.

It features a built-in cash flow statement that allows you to manage and predict your cash flow to track your expenses and have an overview of the amount of money you have to cover bills.

With the expense tracking feature, QuickBooks provides you with key financial reports on expenses and income and profit and loss reports that help you keep tabs on your finances at all times.

Also Read: Best Dubsado Alternatives

10. Live Bookkeepers

One of QuickBooks’ most sought-after features is live bookkeeping. Since you may not always have the time to review your books, QuickBooks offers access to professional bookkeepers who keep your books up to date with guaranteed accuracy.

About 82% of customers agree that QuickBooks Live Bookkeeping helps them focus on their business by removing bookkeeping from their plates.

Certified bookkeepers with over 10 years of experience collaborating with you virtually via video chats to provide essential reports and tax-ready books.

The bookkeepers provide a detailed review of your transactions and a chart of accounts to ensure all previous transactions are accurate and organized.

Also Read: Bonsai vs Dubsado

11. Automated Check Signing

For most businesses, check signing can be tiresome, especially if you deal with many customers. QuickBooks allows you to scan and upload your signatures which you can then use to prepare your checks.

This automated procedure saves you a lot of time and energy and makes check signing much easier.

QuickBooks also features an in-house check printing software that lets you print your checks by connecting them to your printer. This saves you a lot of time and money that could have been spent outsourcing checks from your bank.

Cons of QuickBooks

12. Limited Users and File Size

QuickBooks was developed specifically with small businesses in mind. It was created to serve the needs of small to medium-sized businesses; hence some of its features may be limited as the business expands.

One such limitation is the number of users or files it can handle at a time.

As your company grows, you may be required to increase the number of users who access QuickBooks simultaneously due to an increase in the roles and responsibilities of your employees.

This will also lead to an increase in the volume of transactions being accessed. As a result, the performance of QuickBooks declined.

On many occasions, after the software reaches its limits, users have complained of frequent random crashes being experienced as well as slow performance.

This has become an issue for growing businesses, which on most occasions, end up searching for alternatives.

13. Inability to Restore to a Previous Version

While working on any software, it is almost always impossible to avoid errors. However, most software has restoration points that allow you to access the previous version of your data to revert the error.

QuickBooks, on the other hand, lacks this feature.

If you want to access a certain transaction back from a previous point, you may not be able to do so unless you are on the highest-priced plan.

QuickBooks’ cloud storage saves and updates your data but creates no restoration points. This means you cannot easily access transactions that have been modified or deleted.

To recreate deleted or modified transactions, you must manually enter data, which can be tiresome, especially for large companies, or pay for the advanced plan that automatically creates backups for you.

Many cloud storage applications offer restoration points even for the basic plan. QuickBooks’ inability to support the restoration of previous versions for the basic plan poses a challenge to accountants and businesses that cannot afford the advanced plan.

Also Read: Best Honeybook Alternatives

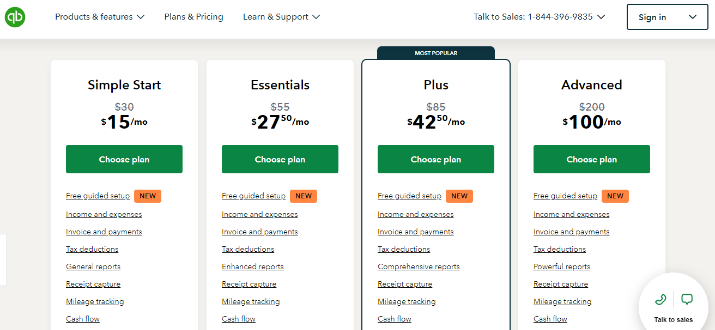

14. Expensive to Maintain and Add Features

While QuickBooks is popular for its numerous and advanced features, one of its biggest drawbacks is its pricing. Maintaining or adding extra features is rather expensive compared to other accounting software.

For example, to add up to 25 users, you must pay for the Advanced Plan option for $100 per month, which is almost seven times the Simple Start Plan that goes for $15 per month.

This becomes a burden, especially to small businesses looking to maintain their books while reducing costs.

That’s not all.

Functionalities such as automated back-ups and customized user access are not available for the small and mid-level tier options but are only accessible on the Advanced tier option. This becomes very challenging for small businesses that may require access to the software’s full features.

In addition, the costly structure of the software extends to its add-ons that require you to pay top dollar to access them.

More details on the pricing can be found on their pricing page.

Explore: Honeybook vs Dubsado

15. Security Concerns from Online Exposure

It is no secret that most processes or software in the modern world revolve around the internet. However, this has stemmed from unauthorized access to sensitive data.

QuickBooks’ online version uses cloud storage to back up data and store your financial and accounting information. However, this can be a security concern because your data gets exposed to the typical risks associated with an online account.

Since financial data is very sensitive, exposing such data to hackers and malicious software can be detrimental to your business, especially in the modern era of internet malpractices.

This then becomes a challenge.

On one hand, you want to take advantage of cloud storage and all its benefits, but on the other hand, you risk exposing your business to viruses and hackers.

Although QuickBooks has guaranteed users data protection using sophisticated measures, it may not be enough to secure your data, especially with technological advancement and cybersecurity risks.

Also Read: Bonsai Alternatives

16. Inadequate Professional Support

Like many of the accounting software available, QuickBooks offers you articles and tutorials that can help you solve some of the common issues you may encounter with the software.

You can also contact QuickBooks for online support.

However, QuickBooks mainly focuses on peer-to-peer customer support. The company’s main strategy is focused on online forums where users post questions about any problems they face when using the software and get answers and solutions from other QuickBooks users.

Even though these forums are very active, it may be difficult to ascertain the truthfulness or reliability of the information you receive from other online users since this may be the main source of support you receive.

Check Out: Best Zelle Alternatives

17. Irregular Updates and Upgrades

Software updates are necessary to improve services as well as fix bugs that are problematic to users.

Since QuickBooks is cloud-based, the software gets updates which can sometimes become an issue. Irregular updates mean you have little control over when the software will update.

If the new version of the software after an upgrade has removed certain features or bugs without your knowledge, you may not be able to access the previous version of the software hence the need to familiarize yourself with the new version.

You also have no control over subsequent annual or monthly subscription costs that may change at any point.

18. Steeper Learning Curve

Most of the accounting software in the market is easy to learn and use, requiring little explanation, even for first-time users.

With QuickBooks, however, that may not be the case. QuickBooks offers a myriad of features that may take some time to understand.

To fully understand all its functionalities, it may require you to know basic accounting principles and concepts.

Although it provides reading support pages, tutorials, and expert advice from professionals, it may require some time to get the hang of using QuickBooks.

Check Out: Best BambooHR Alternatives

Summary

As you can see, there are various benefits and downsides to using QuickBooks.

If you are planning to get a good bookkeeping software, especially QuickBooks, carefully consider its pros and cons.

It will help you pick the best for your business needs.